Through outreach and education programs, Taxpayer Services promotes voluntary compliance with Utah tax statutes. Its employees respond to written, phone, or in-person requests from taxpayers, assisting them in meeting their requirements and in resolving tax issues by providing timely and accurate information. The program also uses the Treasury Offset Program to garnish federal refunds of delinquent Utah taxpayers from the following year. The division also outsources debt collection of accounts that are not in litigation, under a payment agreement, assigned to a collector for active collection, or whose outsourcing would be in violation of state or federal law.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $11,043,400 from all sources for Tax Payer Services. This is a 3.5 percent increase from Fiscal Year 2015 revised estimated amounts from all sources. The total includes $8,604,700 from the General/Education Funds, an increase of 3.6 percent from revised Fiscal Year 2015 estimates.

The Taxpayer Services Division deals with 1.4 million taxpayers directly and indirectly. The top three measures the division uses to monitor performance are 1) Cost of Collection relative to Delinquent Dollar Collected 2) Number of Delinquent Cases Cleared to Zero, and 3) Collection to Receivables Ratio in Days.

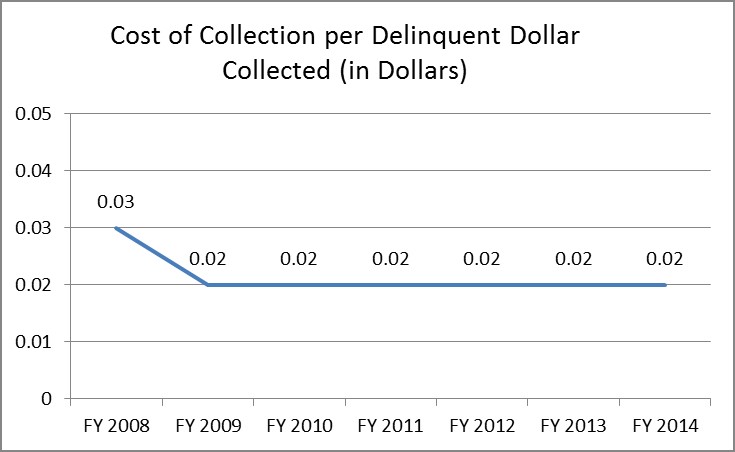

Cost of Collection per Delinquent Dollar Collected

The division strives to maintain a low ratio of collection expenses to delinquent dollars collected.

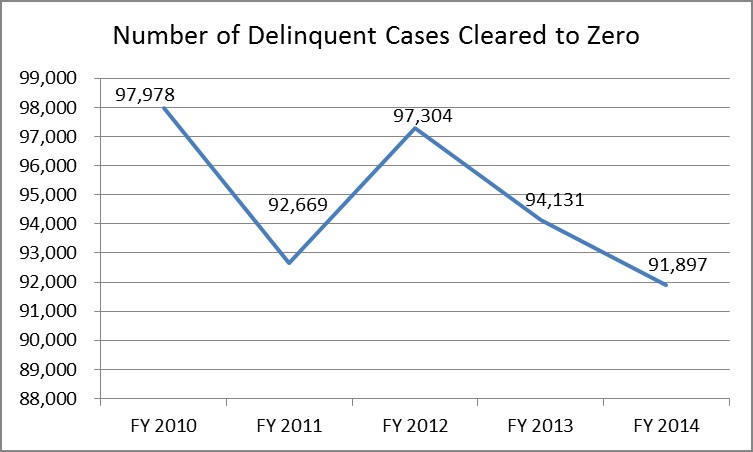

Number of Delinquent Cases Cleared to Zero

This measurement tracks progress on clearing accounts with taxpayers that have outstanding and overdue tax balances. Goals are set each year, with actual results monitored each month.

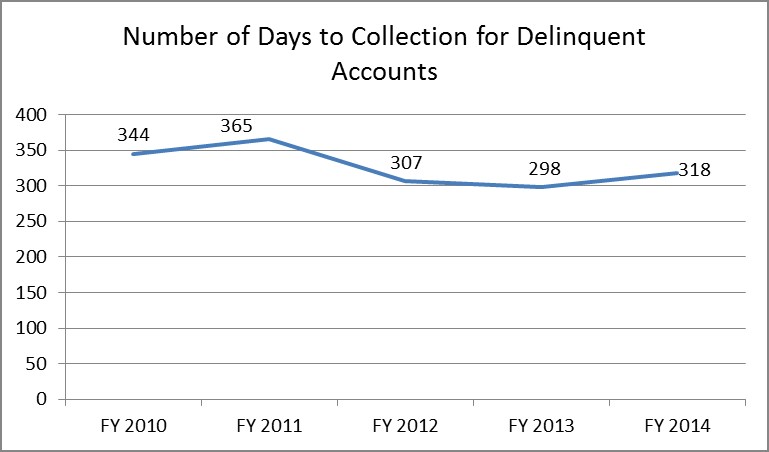

Number of Days to Collection for Delinquent Accounts

This graph shows how many days on average it takes for a delinquent account to be collected.

The Taxpayer Services Division is funded primarily with General Fund, Education Fund, and the Tax Commission Administrative Charge Restricted Account.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.