The Division of Motor Vehicles (DMV) administers statewide vehicle title, registration, and related functions. It implements motor vehicle policy and procedure and helps maintain the State's motor vehicle computer system. Also, the DMV provides training to all customer service agents, manages a telephone section for statewide assistance, processes impound and revocation information, and manages vehicle-related appeals. Additionally, the DMV administers the International Registration Plan and the International Fuel Tax Administration Plan.

Utah Code 59-2-406 authorizes the Tax Commission to contract with county governments, at the counties' option, to provide local customer services for the combined collection of the county's fee-in-lieu and Title 41 Motor Vehicle Fees. Several counties have elected to retain those functions. Fees for the reciprocal services provided between the State and counties are established in statute. Subsection 406 (3) sets the reimbursement fee and instructs that an adjustment be made each year based on the prior year's consumer price index change. The approval of fees is made by the Legislature.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $22,770,600 from all sources for Motor Vehicles. This is a 4.1 percent increase from Fiscal Year 2015 revised estimated amounts from all sources. The total includes $8,100,300 from the General/Education Funds, an increase of 5.2 percent from revised Fiscal Year 2015 estimates.

In addition to statewide compensation and internal service fund cost increases, the following appropriation adjustments were made during the 2015 General Session:

The top three measures used by the Motor Vehicles division to assess performance are, 1) Average and Maximum Wait Time, 2) Percent of Renewals Completed Online, and 3) successful development, testing, and implementation of new computer systems.

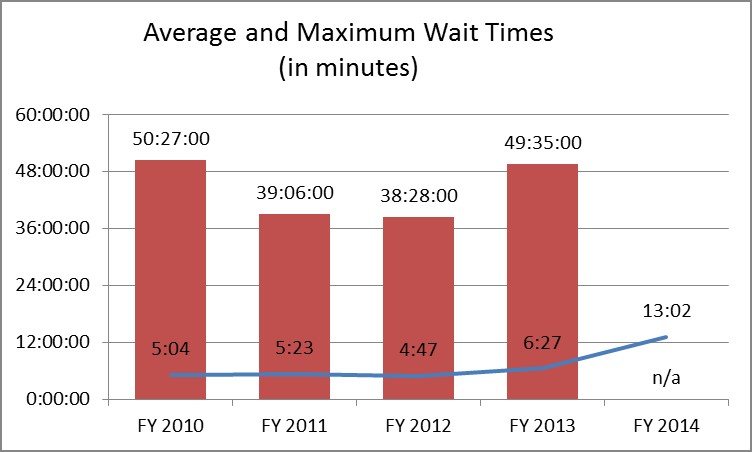

Average and Maximum Wait Times

Timely assistance in Motor Vehicle Offices is important to citizens. This measure is used to monitor wait times and adjust staffing as necessary.

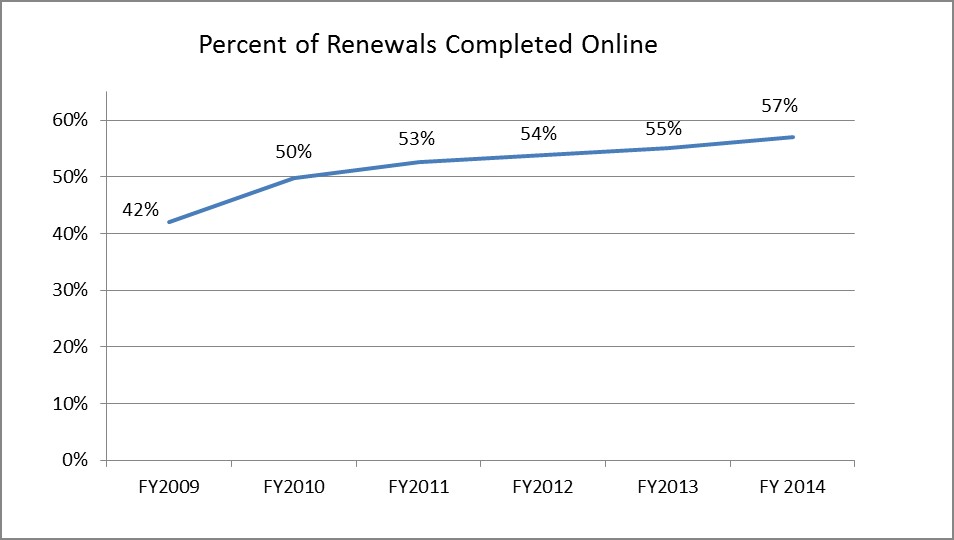

Percent of Renewals Completed Online

Online renewal options are continuously promoted, since those transactions require fewer resources and reduce wait times in the offices. The division considers the increasing use of online transactions as indicative of its effort to improve efficiency.

Successful Implementation of New Motor Vehicle System

A new Motor Vehicle system was successfully deployed as planned in October 2013 to all state, county and third party offices. Since Motor Vehicle work relies on its computer systems, the smooth transition from the old system to the new one was critical. Many interfacing systems were successfully linked with the new system at the time of deployment.

The new system was developed to meet all of Utah's title and registration requirements; all the different functions were thoroughly tested before deployment. Just prior to implementation, training was provided to all front-line users of the system throughout the state, in both state and county run offices, and with third party entities.

All motor vehicle offices are successfully using this new system to perform the state's motor vehicle title and registration work, and the system's centralized accounting and distribution functions are processing the numerous tax and fees that are related to vehicle transactions. The new system is also providing law enforcement with registration information in a more complete and timely manner.

Utah Annotated Code Title 41 covers the State's motor vehicle laws. Title 41, Chapter 1a is the primary section administered by the Motor Vehicle Division, which includes registration requirements and motor vehicle fees. The Motor Vehicle Division also draws authority from Title 41, Chapter 22 to administer Off-Highway vehicle registration requirements, and Title 73, Chapter 18 to administer Boat Registration and Fee requirements.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.