Mission: To enhance the quality of life by preserving and providing natural, cultural, and recreational resources for the enjoyment, education, and inspiration of this and future generations.

Currently, Utah has 43 state parks that are a combination of heritage, scenic and recreation parks (click on the link http://naturalresources.utah.gov/divisions/state-parks.html to go to the website). Created under UCA 79-4-201, the division is responsible for management and development of all state parks, the administration and enforcement of the State Boating Act and the state off-highway vehicle program. The Board of Parks and Recreation provides policy direction.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $30,462,700 from all sources for Parks and Recreation. This is a 4 percent increase from Fiscal Year 2015 revised estimated amounts from all sources. The total includes $4,661,800 from the General/Education Funds, an increase of 12 percent from revised Fiscal Year 2015 estimates.

In addition to statewide compensation and internal service fund cost increases, the following appropriation adjustments were made during the 2015 General Session:

The following are the top measures chosen by division management to gauge the success of its programs.

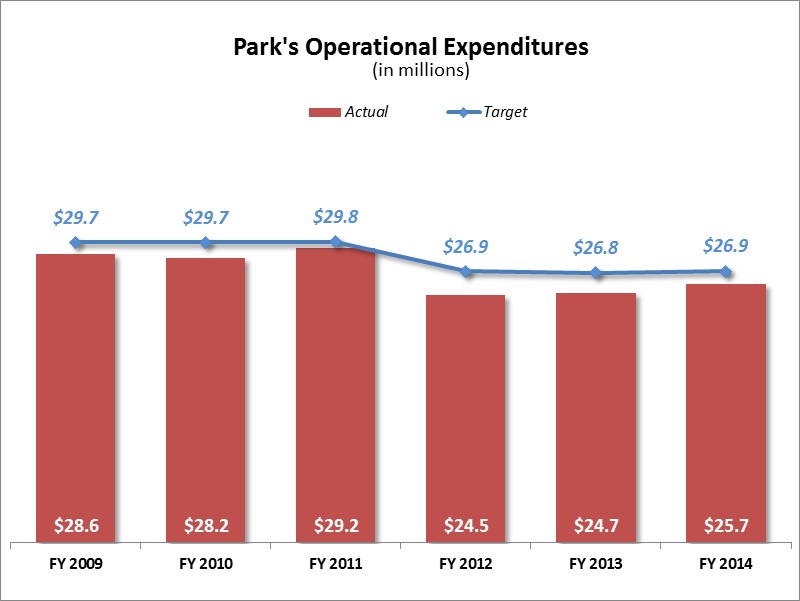

Parks Operations’ Expenditures

Expenditures: The division is using this measure to track its expenditures.

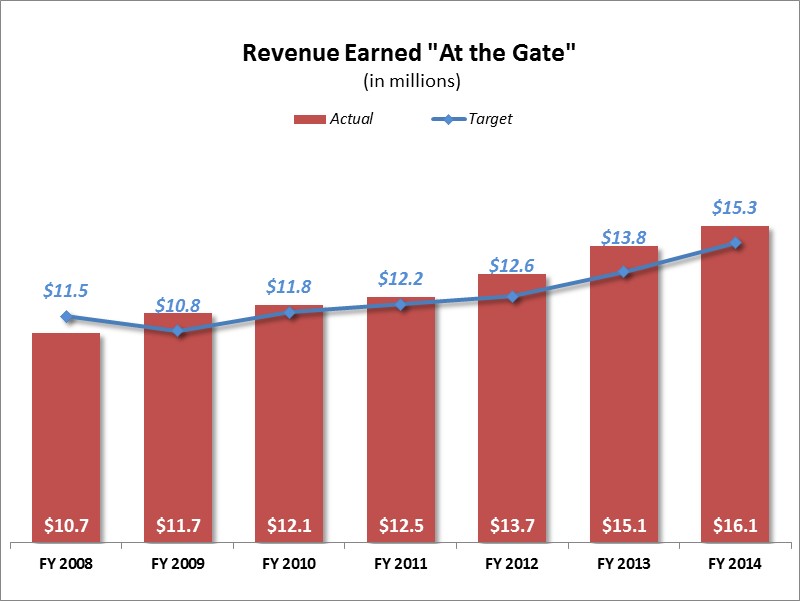

Revenues Earned “At the Gate”

"At the Gate" Revenue: Parks' goal is to attract more visitors each year. Rather than trying to count or estimate the number of visitors entering each park, the division is using actual revenue collected "at the gate" to measure their visitation.

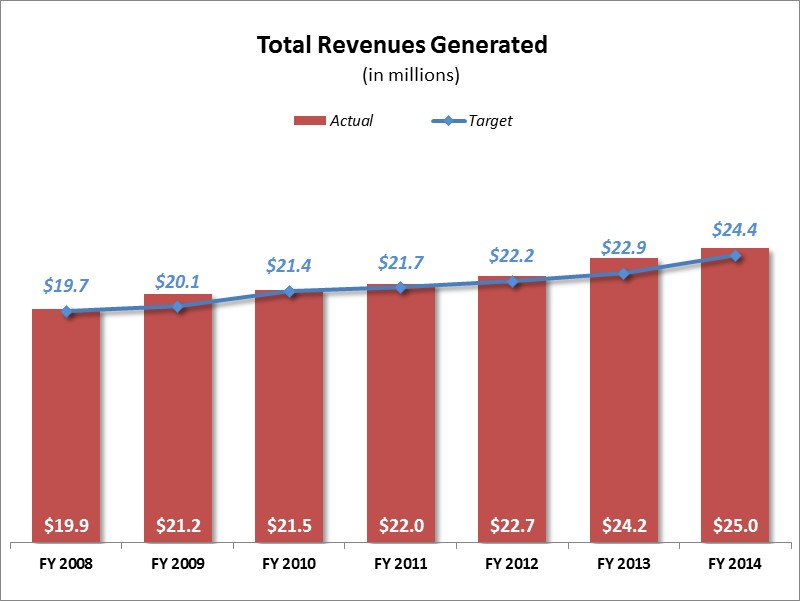

Total Revenues Generated

Total Revenue Earned: Division leadership has chosen this measure with the intention to help them keep track of the revenues generated by staff. The goal is to increase revenue by 1% over the prior year's collections.

The Division of Parks and Recreation has two line items in its budget: Operations and Capital. The funding from the Operations line item is used for the management and development of all state parks, statewide boating safety and statewide off-highway vehicle safety. The funds from the Capital line item are used for the capital improvements and development of the facilities and infrastructure of the state parks.

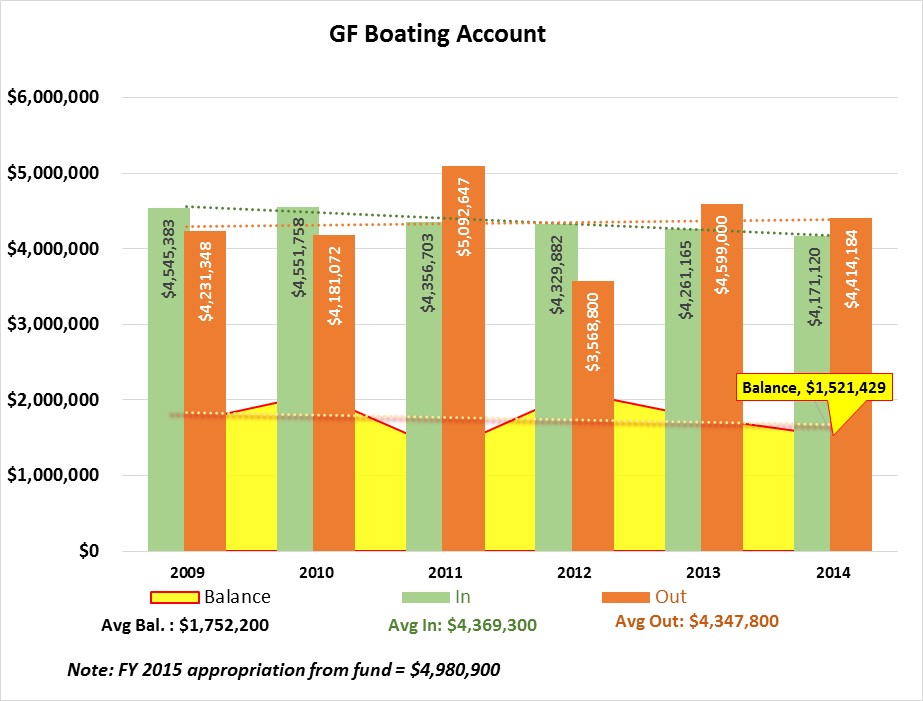

Boating Account revenues come from boat registration fees as well as from gasoline tax. Potential projects must be directly related to boating recreation and be available to the general public.

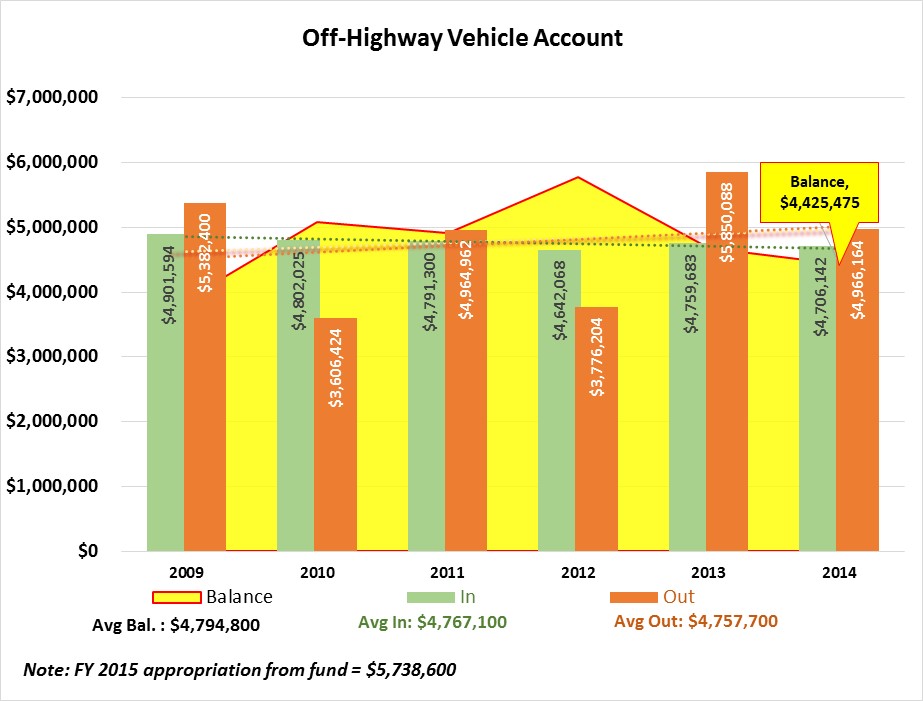

The state Off-Highway Vehicle (OHV) Account is generated from off-highway vehicle registration fees and gasoline tax. OHV account proceeds are generally limited in scope and are usually solicited to leverage federal matching funds (such as Land and Water Conservation Fund) for projects that have an OHV recreational component. Examples include trailhead development, campground facilities for OHV users, restrooms near trails, and motocross tracks. These funds are generally limited in amount and are available on an "ad-hoc" basis.

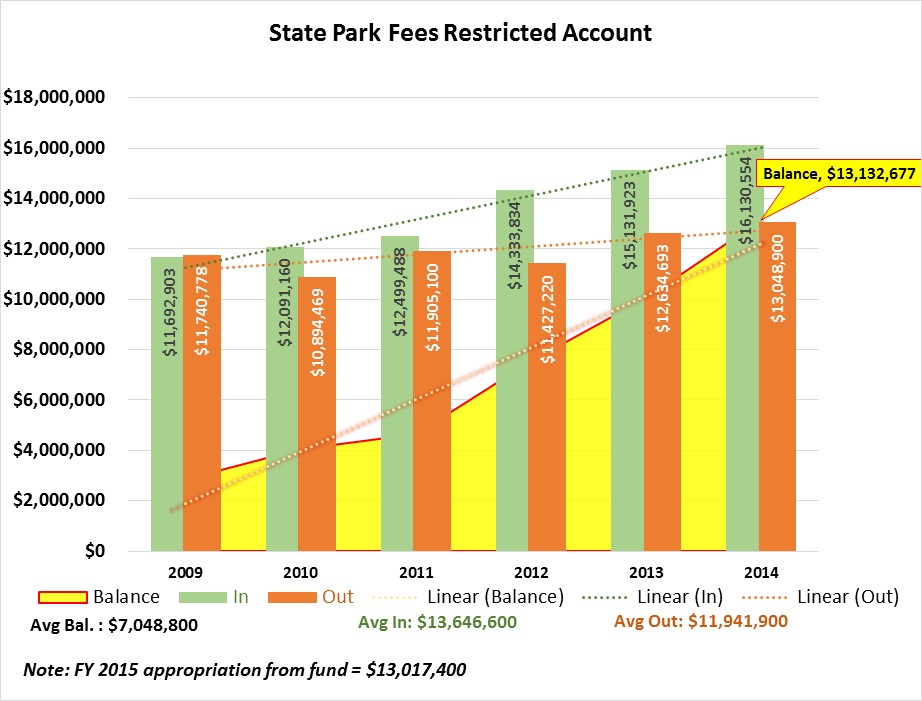

The revenues for the State Park Fees Restricted Account primarily come from park entrance fees, camping, and golf.

Special Funds

The figures below show the division's major restricted funds over time: each fund's activities, the appropriated amount for the current fiscal year, as well as the average revenues, expenditures, and balances.

Revenue sources for the Fees Restricted Account:

Fees from entrance, camping, golfing; sales of buffalo (State Park Fees Account: UCA 79-4-402)

Revenue sources for the OHV Account:

Motorboat and sailboat registration fees (Off-Highway Vehicles Account: UCA 41-22-19)

Fuel tax (59-13-201 (8): Motor and Special Fuel Tax Act)

Revenue sources for the Boating Account:

Motorboat and sailboat registration fees (Boating Account: UCA 73-18-22)

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.