The Navajo Revitalization Fund is to help the Navajo Nation Reservation in San Juan County, Utah with capital projects, infrastructure, housing projects, educational endowments, and promotion of Navajo culture. Funds may not be used for general operating budgets of eligible entities nor for costs of private business ventures. Eligible entities include the Navajo Nation and its divisions as well as nonprofit organizations that may be impacted by mineral resource development.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $2,043,200 from all sources for Navajo Revitalization Fund. This is a 0 percent change from Fiscal Year 2015 revised estimated amounts from all sources.

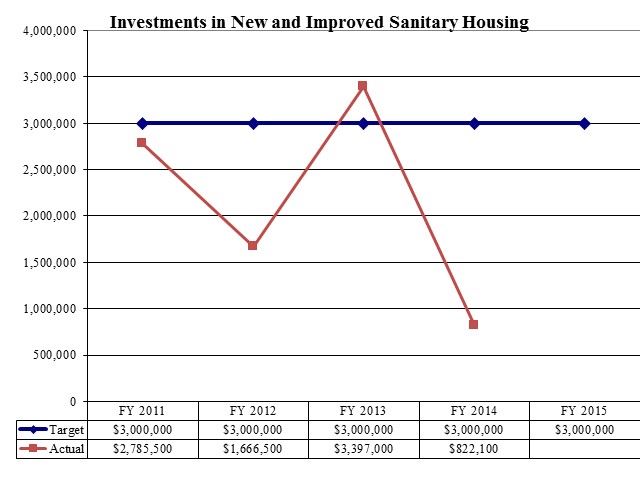

Statutory authority for the Fund comes from UCA 35A-8-1704 and 59-5-119. This Fund receives revenue automatically as per UCA 35A-8-1704. For Navajo lands, the Fund receives 33% of severance taxes from wells existing before July 1996 and 80% of taxes from new wells beginning production on or after July 1996. The maximum annual deposit cannot exceed $3,000,000. If the annual deposit were to exceed $3,000,000 then the excess would go into the General Fund. UCA 35A-8-1704 allows for up to 4% of the annual revenues for administration of the Fund.

For more detail about a particular source of finance or organizational unit, click a linked entry in the left column of the table(s) below.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.