The programs in the Community Development Capital Budget mitigate the impacts of non-metallic mineral extraction and help fund special service districts. Funding sources for the program are mineral lease royalties returned to the State by the federal government.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $125,180,000 from all sources for Community Development Capital Budget. This is a 7.5 percent increase from Fiscal Year 2015 revised estimated amounts from all sources.

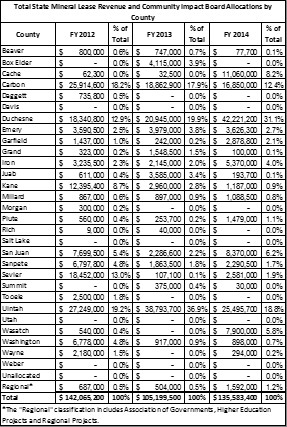

Total State Mineral Lease Revenue and Community Impact Board Allocations by County

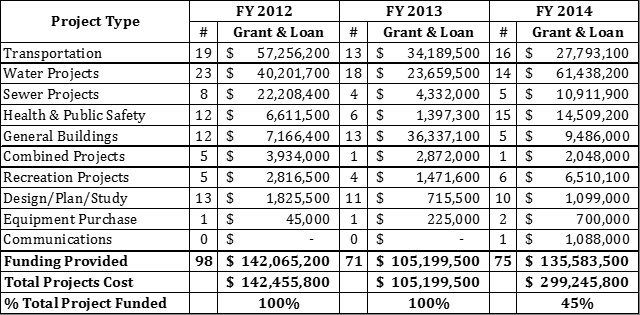

Total State Mineral Lease Revenue and Community Impact Board Allocations by Project Type

Utah is energy rich in coal, hydroelectric, geothermal, natural gas, uranium and crude oil. The energy industry not only includes production of energy fuels, but the conversion of these resources into other forms of energy such as petroleum and electricity. This energy is used in Utah, shipped to other surrounding states, or exported to overseas markets.

In order to help mitigate local impacts of major energy and mineral development on federal lands, the federal government returns half of the royalty revenues collected back to the State of origin. The royalties collected are called mineral lease funds. Because of the prevalence of federal lands in Utah, these impacts are extensive.

Utah puts the revenue into two General Fund restricted accounts. The Mineral Lease Account is general royalty revenue returned to the State. The Mineral Lease Bonus Account originally came from the Department of Interior oil shale prototype leases known as U-a and U-b, located in eastern Utah. Currently, Bonus Revenue includes revenue from lease renewal fees and leases obtained from new mineral development.

The majority of the funds go out as loans, which do not show up in the expenditure detail below. These loans show up as receivables on other financial statements. For analysis of current budget requests and discussion of issues related to this budget click here.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.