The Unemployment Insurance (UI) Program was created as part of the federal Social Security Act of 1935. The program is operated by each state in coordination with the federal government. The Department of Workforce Services operates this program for the State of Utah.

According to statute, the program collects employer contributions for deposit in a restricted account, determines eligibility, and pays weekly benefits from the restricted account to unemployed workers. Administrative costs are federally funded.

The Unemployment Insurance line item contains the administrative piece of the program, whereas the Unemployment Compensation Fund line item contains only the amount carried in the Unemployment Restricted Account appropriated to pay benefits.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $21,356,400 from all sources for Unemployment Insurance. This is a 0.2 percent increase from Fiscal Year 2015 revised estimated amounts from all sources. The total includes $572,200 from the General/Education Funds, an increase of 3.6 percent from revised Fiscal Year 2015 estimates.

In addition to statewide compensation and internal service fund cost increases, the following appropriation adjustments were made during the 2015 General Session:

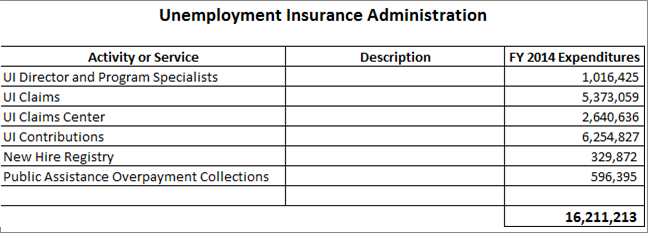

Separate tables are shown under the tab labeled "Financials" in each COBI section. These tables provide information regarding: 1) funding sources (where the money comes from), 2) standardized state expenditure categories (where the money goes), and 3) agency sub-programs (when viewed at the line item level). For the most recent completed fiscal year, the following information represents the purposes for which the money was used:

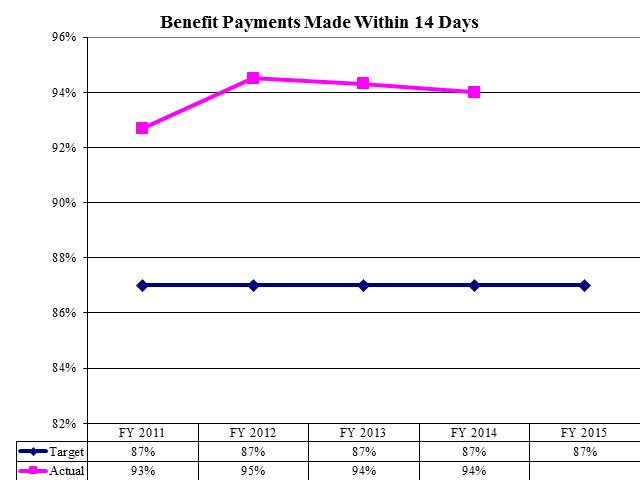

Benefit Payments Made Within 14 Days

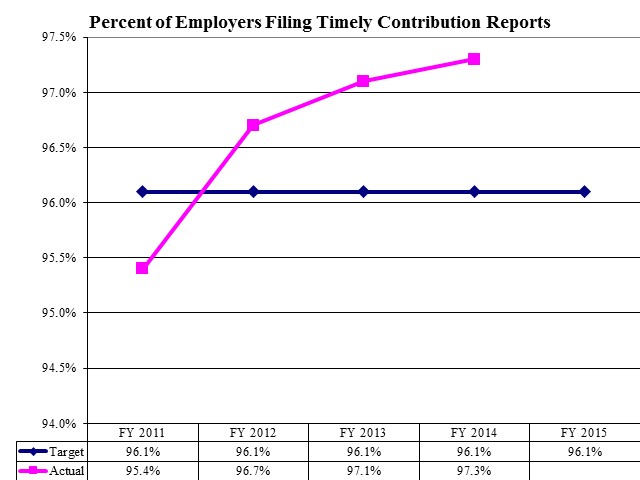

Percent of Employers Filing Timely Contribution Reports

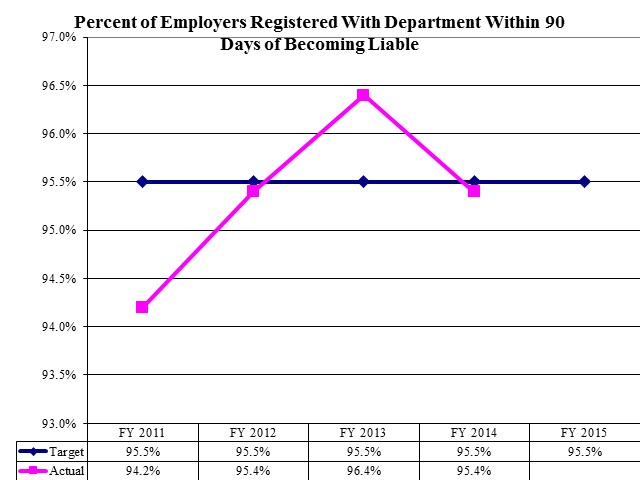

Percent of Employers Registered With Department Within 90 Days of Becoming Liable

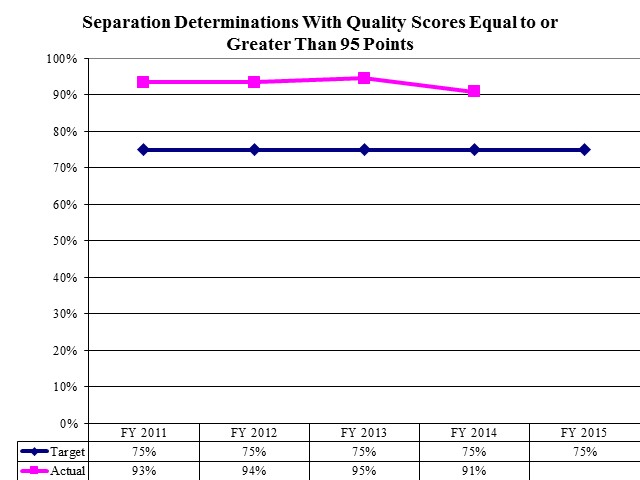

Separation Determinations With Quality Scores Equal to or Greater Than 95 Points

Authority to conduct the Unemployment Insurance Program in Utah is found in UCA 35A-4, Employment Security Act.

For analysis of current budget requests and discussion of issues related to this budget click here.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.