The Unemployment Compensation Fund provides a temporary living allowance while an unemployed worker looks for new employment. Unemployment compensation benefits are funded almost exclusively through a dedicated tax paid by employers. Additional benefits may be paid by the federal government in times of high unemployment. For FY 2014, 85,510 individuals were assisted by unemployment insurance.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $281,913,300 from all sources for Unemployment Compensation Fund. This is a 5.1 percent reduction from Fiscal Year 2015 revised estimated amounts from all sources.

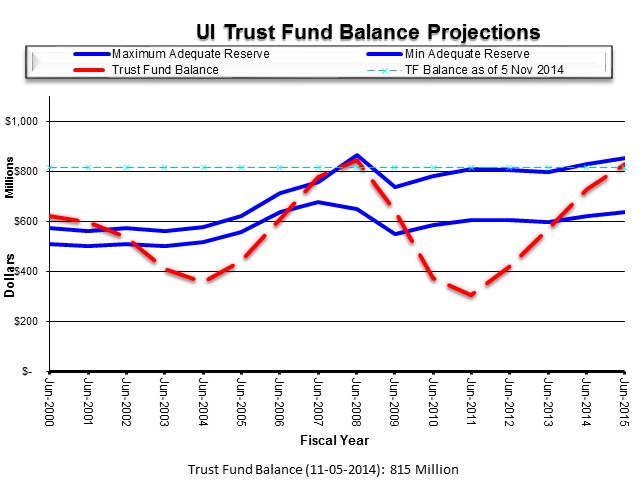

The Department of Workforce Services measures the performance and health of the Unemployment Compensation Fund by monitoring its Trust Fund portion. The figure from DWS below shows the counter-cyclical nature of benefits paid and revenue received by the Trust Fund.

Source: Department of Workforce Services

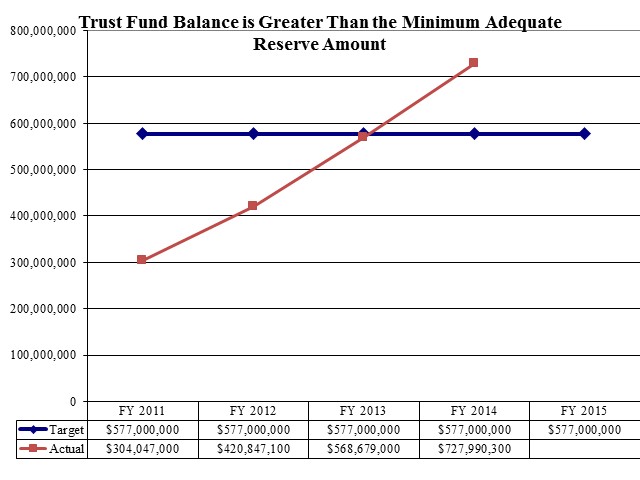

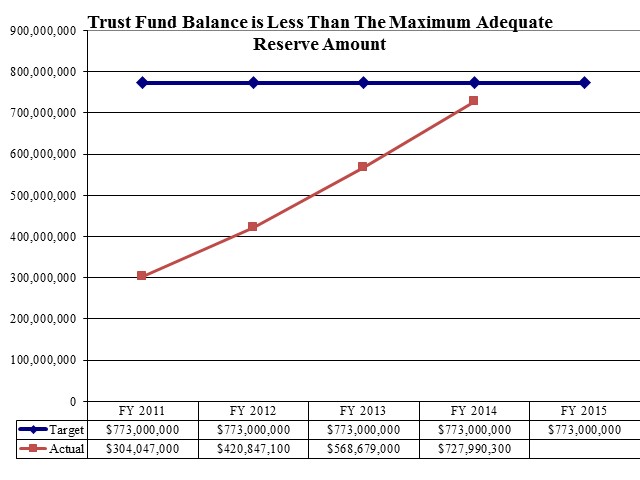

DWS attempts to keep Trust Fund balances in a range such that they are sufficient to pay between 18 months and 24 months in benefits. The figure from DWS below tracks balances in relation to that range.

Figure 2

Source: Department of Workforce Services

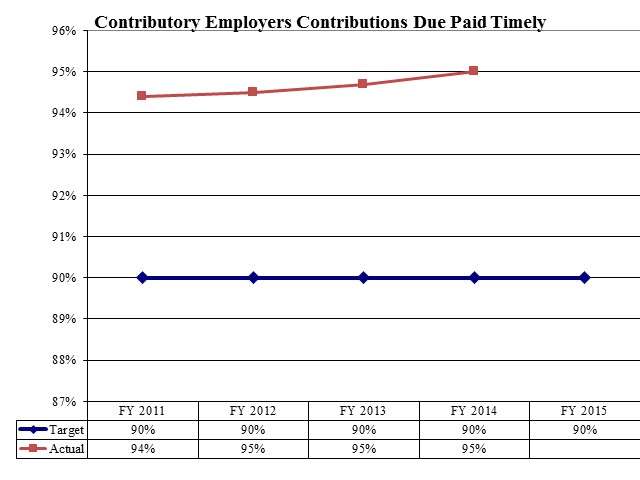

Contributory Employers Contributions Due Paid Timely

Re-employment Rate for All Claimants

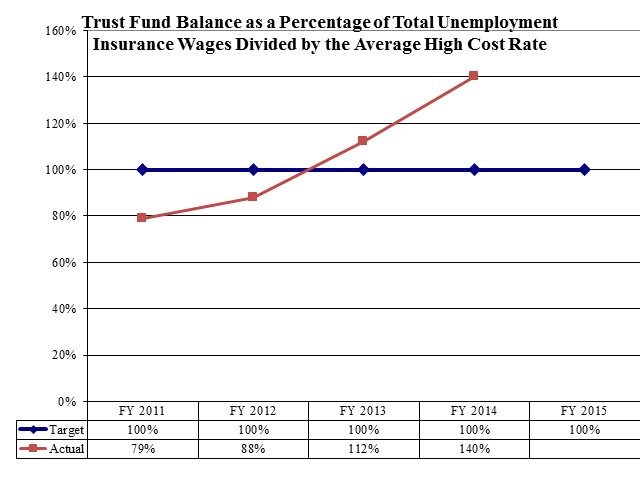

Trust Fund Balance as a Percentage of Total Unemployment Insurance Wages Divided by the Average High Cost Rate

Trust Fund Balance is Greater Than the Minimum Adequate Reserve Amount

Trust Fund Balance is Less Than The Maximum Adequate Reserve Amount

Participating Unemployment Insurance employers pay contributions to that portion of the Unemployment Compensation Fund commonly known as the Unemployment Insurance Trust Fund. Contribution rates are unique to individual employers and are set according to statutory formula. That formula considers an employer's unemployment benefits costs, total taxable wages, the health of the Unemployment Insurance Trust Fund (referred to as the reserve factor), and benefit costs that can't be charged to specific employers (referred to as social cost). The rate is calculated as follows:

The reserve factor is a multiplier that is adjusted up or down depending upon the health of the Unemployment Insurance (UI) Trust Fund. In bad economic times, the fund is drawn down and the reserve factor goes up. In a good economy, the fund may thrive, in which case the reserve goes down. When the UI Trust Fund has a balance that is sufficient to pay between 18 and 24 months of benefits in a severe economic downturn, the reserve factor is 1.00.

The social cost factor is added to all participants rates as a means to cover costs that cannot be charged to any one employer. An example of such a cost is benefits paid to former employees of a business that has closed. This factor is determined using the experienced social cost for the past four years in comparison to the total taxable wages.

Benefit ranges from $26 to $487 per week (average is $348) based on wages earned during the first four of the last five completed quarters or the last four completed quarters. The state pays up to 26 weeks maximum (average is 13.4 weeks). Unlike recent years, the federal government does not currently provide any additional Emergency Unemployment Compensation after state benefits are exhausted. The benefit amount depends upon a person's earnings history.

Once approved, the applicant must file an on-line weekly claim showing at least four new job contacts per week and provide information regarding whether the applicant worked in the last week or went to school. A recipient must report part-time or temporary work as part of the weekly claim. The benefit ends when full-time employment is secured, the benefit amount is exhausted, or the claim expires after 52 weeks.

Eligibility: Eligibility is not need-based. A qualified individual who is unemployed through no fault of his/her own must be able and willing to work and may receive benefits if the individual earned at least $3,300 in the previous year and is:

- looking for full-time work;

- in approved training; or

- awaiting recall to employment.

For analysis of current budget requests and discussion of issues related to this budget click here.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.