The Qualified Emergency Food Agencies Fund provides funding to qualified emergency food agencies for the purchase of food for distribution to individuals. Based on current law, the Qualified Emergency Food Agencies Fund receives its revenue automatically and can spend all revenues without additional Legislative action.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $828,700 from all sources for Qualified Emergency Food Agencies Fund. This is a 0 percent change from Fiscal Year 2015 revised estimated amounts from all sources.

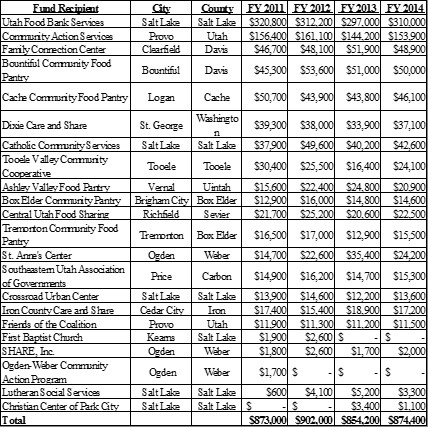

Services Provided From FY 2011 to FY 2014

The Fund is for providing food to low-income individuals. In FY 2014 the fund helped provide food via 21 agencies. The grants ranged from $700 to $310,000. Below are the tables that show the grants provided from FY 2011 through FY 2014:

This Fund receives revenue automatically each year from the following sources:

- $533,750 annually from the sales and use tax as per UCA 59-12-103

- A portion determined by a commission of sales taxes charged by local municipalities as per UCA 59-12-204

- A portion determined by a commission of sales taxes charged by counties as per UCA 59-12-1102

UCA 35A-8-1009 directs that emergency food agencies serving low income individuals can receive up to 12 cents for every pound of food donated to them.

For more detail about a particular source of finance or organizational unit, click a linked entry in the left column of the table(s) below.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.