Mission: To maximize the commercial gain from trust land uses consistent with long-term support of beneficiaries and to manage school and institutional trust lands for their highest and best trust-land use.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $10,601,100 from all sources for School and Inst Trust Lands. This is a 2.9 percent increase from Fiscal Year 2015 revised estimated amounts from all sources.

In addition to statewide compensation and internal service fund cost increases, the following appropriation adjustments were made during the 2015 General Session:

The following are the top measures chosen by the agency management to gauge the success of its programs.

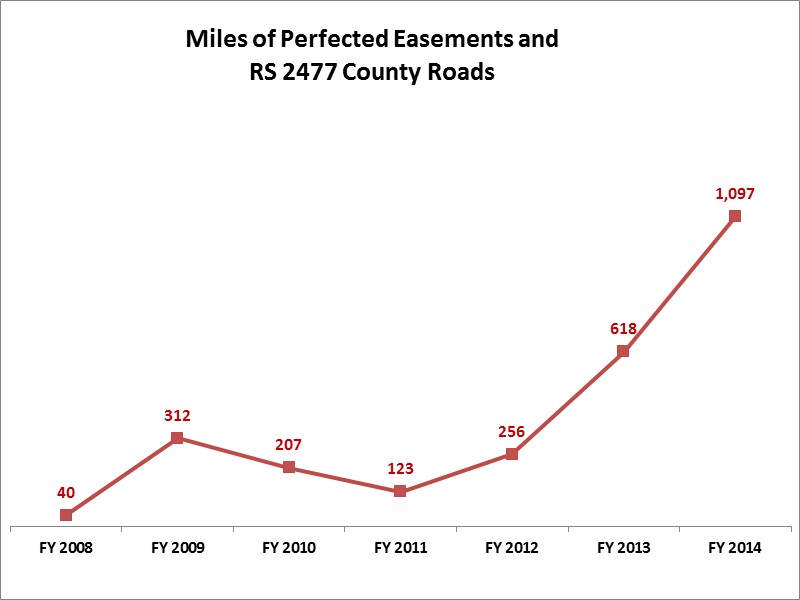

Miles of Perfected RS 2477 County Roads

RS 2477: The first performance measure tracks the road miles analyzed and perfected as permanent easements or acknowledged by Disclaimer of Interest. The agency goal is to analyze and issue easements or Disclaimers of Interest on mileage of Class D county roads within 5 counties each year. No goal is set for the mileage per year because this varies widely by county.

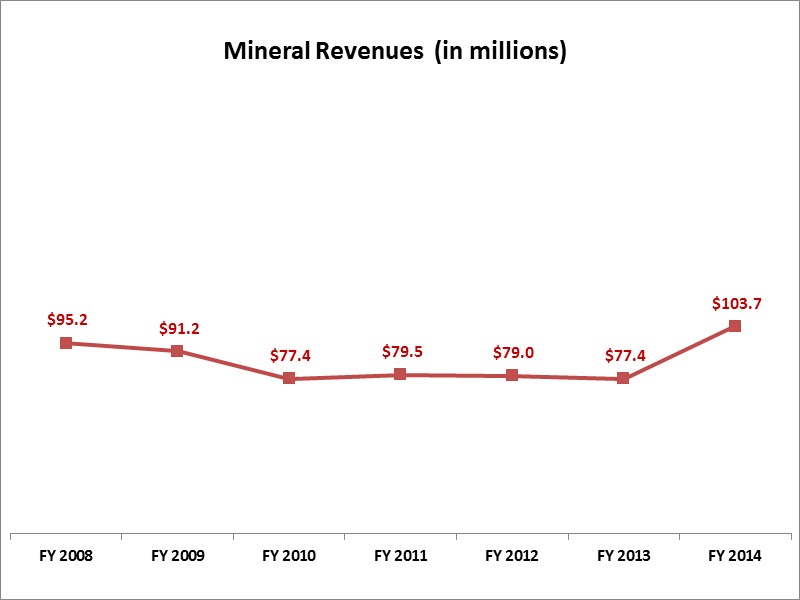

Revenue Earned from Mineral Operations on SITLA Lands

Revenes: The second performance measure tracks the revenue earned from mineral operations on SITLA lands.

The following laws govern operations of SITLA:

- UCA 53C is known as the "School and Institutional Trust Lands Management Act." Highlights include the following:

- The state has a duty of undivided loyalty to the beneficiaries.

- The administration is an independent state agency and not a division of any other department.

- The administration is subject to most of the usual legislative and executive department controls. Certain exceptions are made in matters of confidentiality, rulemaking, personnel issues, and the procurement code.

- The board may create an annual incentive and bonus plan for the director and other administration employees designated by the board, based upon reaching measurable goals.

- The administration is managed by a director appointed by the Board of Trustees.

- UCA 53C-1-202 creates the seven-member Board of Trustees. Members are appointed on a nonpartisan basis by the governor with the consent of the Senate.

- UCA 53C-1-204 spells out requirements for the policies established by the board.

- UCA 53C-3 creates the Land Grant Management Fund. Revenue comes from:

- trust lands except revenues from the sales of those lands

- interest earned by the fund

- other activities of the agency

- sales of school trust lands is deposited in the Permanent State School Fund.

- UCA 53C-3-101 allows the director to expend monies from the fund in accordance with the approved budget to support the agency. Any unspent amount is distributed back to the beneficiaries.

- UCA 53C-3-104 requires money from the sale or management of reservoir lands to be deposited in the Water Resources Construction Fund created in UCA 73-10-8.

- 53C-3-202 details collection and distributions of revenues from federal land exchange parcels.

Funding for SITLA operations is provided through the Land Grant Management Fund (an enterprise fund), which consists of:

- Revenues provided from trust land activities other than land sales. (Revenues from land sales go directly to the nonexpendable trust fund of the land's designated beneficiary.)

- Revenues from other activities of the Administration.

Land use revenues include licenses, permit fees, royalties, and lease revenues charged for the use of trust lands. In exchange, SITLA allows the use of selected trust lands for activities such as grazing, logging, mineral extraction, commercial leasing, and development.

Revenues that have not been appropriated for use by SITLA are distributed directly to the beneficiaries or the Permanent School Fund. Unexpended appropriations to SITLA are also distributed to the beneficiaries or to their trust funds.

In 1999 SITLA traded 377,000 acres of trust lands isolated within federal lands for $50 million cash, $13 million in future coal revenue, coal and coal bed methane, and 139,000 acres of land or surface/mineral rights with readily developable commercial and mineral value. Today those acquired lands are the base of the agency's single largest revenue source, natural gas royalties.

Interest and dividend income from the Permanent School Fund is directly distributed to individual schools through the Utah State Office of Education. Passage of Constitutional Amendment Number One (effective January 1, 2003), eliminated the requirement that a portion of interest earnings be held back as a protection against inflation, and clarified that stock dividends are part of the "interest" earnings that may be distributed.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.