The Permanent Community Impact Fund helps mitigate the impacts of non-metallic mineral extraction on services traditionally provided by government entities. Funding sources are mineral lease royalties returned to the State by the federal government. The Fund provides grants and/or loans to subdivisions of the State for public facilities which are impacted directly or indirectly by mineral resource development on federal lands.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $67,473,700 from all sources for Permanent Community Impact Fund. This is a 1.6 percent increase from Fiscal Year 2015 revised estimated amounts from all sources.

FY 2014 ended with $64,269,700 million in uncommitted funds.

Six Projects Denied During FY 2014 for Not Meeting Statutory Guidelines

- Price City - $70,000 for removing two fuel tanks. The city requested help with two projects and had some cash for both projects. The Board decided that it could not justify the fuel tank removal. The Board added $70,000 funding help to the other eligble project.

- Helper City - $960,800 to restore the Price River waterway. The project is not infrastructure and does not meet the statutory requirements of funding.

- Elwood Town - $4,000 grant for an ordinance review and update. The Board directed the town to work with the Community Impact Board regional planner.

- Elwood Town - $17,500 for a water source improvement plan. The project was mostly engineering and the Board does not fund stand-alone engineering.

- Washington City - $37,000 grant for the design of a public safety facility. The Board does not fund stand-alone design projects.

- Northwestern Special Service District - $15,000 grant for the design of a new fire station. The Board does not fund stand-alone design projects.

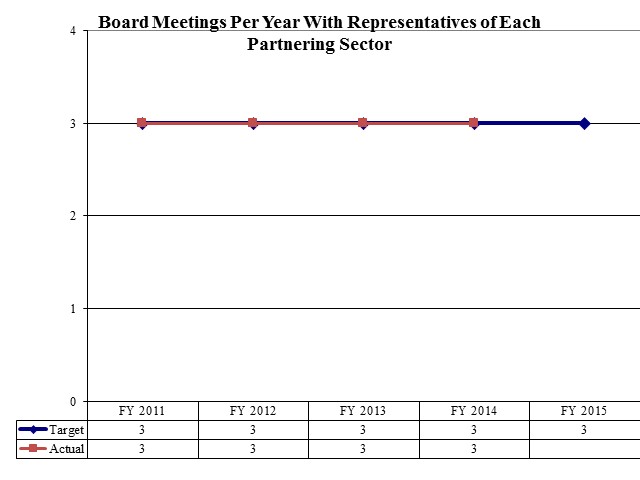

Board Meetings Per Year With Representatives of Each Partnering Sector

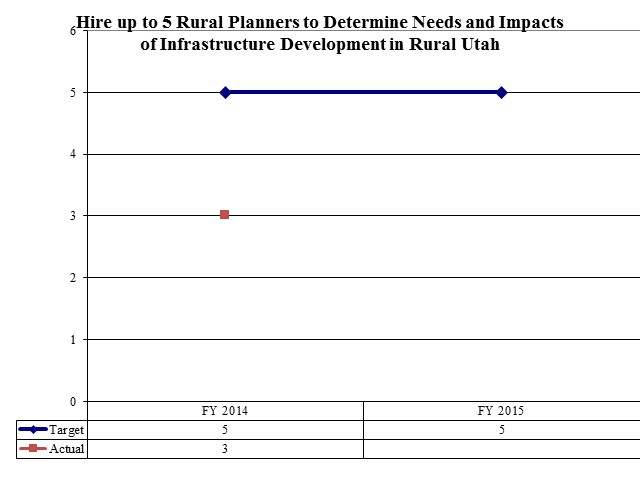

Hire up to 5 Rural Planners to Determine Needs and Impacts of Infrastructure Development in Rural Utah

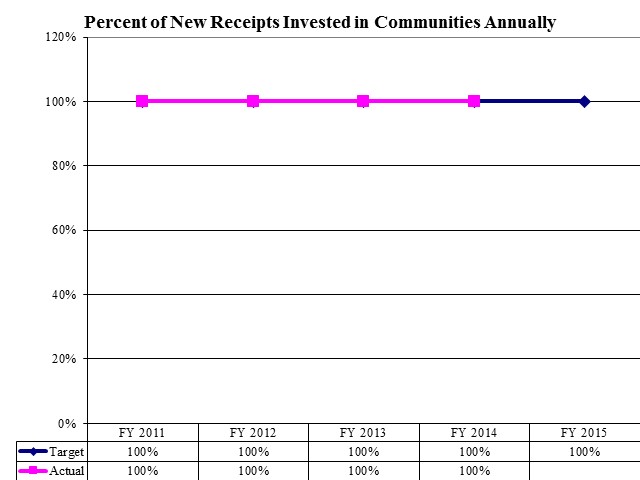

Percent of New Receipts Invested in Communities Annually

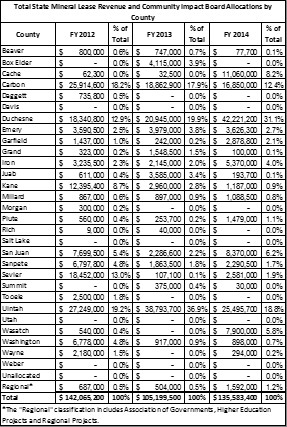

Total State Mineral Lease Revenue and Community Impact Board Allocations by County

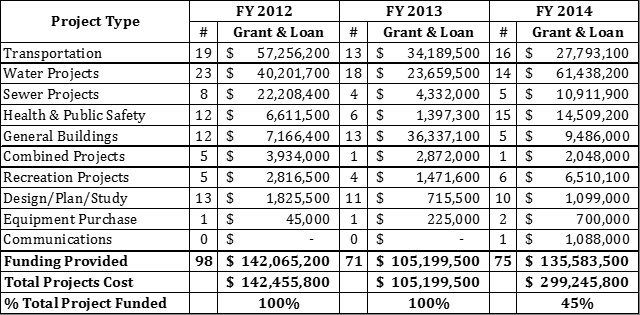

Total State Mineral Lease Revenue and Community Impact Board Allocations by Project Type

A governing board decides who receives the funds from the Permanent Community Impact Fund. UCA 35A-8-304 provides the following for the 11 member governing board (or their designee for the first four members):

- Board of Water Resources Chair

- Water Quality Board Chair

- Transportation Commission Chair

- Department of Workforce Services Director

- State Treasurer

- Locally-elected official from Carbon, Emery, Grand, or San Juan County

- Locally-elected official from Juab, Millard, Sanpete, Sevier, Piute, or Wayne County

- Locally-elected official from Duchesne, Daggett, or Uintah County

- Locally-elected official from Beaver, Iron, Washington, Garfield, or Kane County

- Locally-elected official from the county that produced the most mineral lease money

- Locally-elected official from the county that produced the second most mineral lease money

The Department has a competitive grant process for applicants, which considers an entity's resources to repay a loan as well as other sources to pay for proposed projects. In general, the Department limits funding to $5,000,000 per project. The governing board makes funding decisions three times per year.

The majority of the funds go out as loans, which do not show up in the expenditure detail below. These loans show up as receivables on other financial statements. The ending balance has both committed and uncommitted funds. Committed funds can take years to pay out as disbursements go out as approved expenditures are submitted over the life of each project.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.