HB0003: Item 83Under Section 63J-1-603 of the Utah Code the Legislature intends that up to $200,000 of the appropriations provided for the Administration line item in Item 29 of Chapter 13 Laws of Utah 2014 not lapse at the close of Fiscal Year 2015. The use of any nonlapsing funds is limited to computer equipment and software and special projects and studies.

HB0003: Item 83The Legislature intends that the Department of Workforce Services prepare proposed performance measures for all new state funding or TANF federal funds for building blocks and give this information to the Office of the Legislative Fiscal Analyst by June 30, 2015. At a minimum the proposed measures should include those presented to the Subcommittee during the requests for funding. If the same measures are not included, a detailed explanation as to why should be included. The Department of Workforce Services shall provide its first report on its performance measures to the Office of the Legislative Fiscal Analyst by October 31, 2015. The Office of the Legislative Fiscal Analyst shall give this information to the legislative staff of the Health and Human Services Interim Committee.

HB0003: Item 83The Legislature intends the departments of Health, Human Services, and Workforce Services and the Utah State Office of Rehabilitation provide to the Office of the Legislative Fiscal Analyst by June 1, 2015 a report outlining how funds are distributed within the state when passed through to local government entities or allocated to various regions and how often these distributions are reviewed and altered to reflect the relevant factors associated with the programs. (1) Is the program considered a statewide program (this would include something that serves all rural areas)? a. Is the implementation of the program really statewide? If not, is there a compelling reason why? (2) Who gets the money (by county)? (3) What is the methodology for distributing the money? a. How does the distribution compare to actual need as expressed by population? i. [If distributions are not reflecting current need (as represented by population), please explain why not?] b. If not done by population, what is the reason? (4) Does statute say anything about distribution and equity for the program?

SB0002: Item 76The Legislature intends that the American Recovery and Reinvestment Act appropriation provided for the Administration line item is limited to one-time projects associated with Unemployment Insurance modernization.

SB0002: Item 76All General Funds appropriated to the Department of Workforce Services - Administration line item are contingent upon expenditures from Federal Funds - American Recovery and Reinvestment Act (H.R. 1, 111th United States Congress) not exceeding amounts appropriated from Federal Funds - American Recovery and Reinvestment Act in all appropriation bills passed for Fiscal Year 2016. If expenditures in the Administration line item from Federal Funds - American Recovery and Reinvestment Act exceed amounts appropriated to the Administration line item from Federal Funds - American Recovery and Reinvestment Act in Fiscal Year 2016, the Division of Finance shall reduce the General Fund allocations to the Administration line item by one dollar for every one dollar in Federal Funds - American Recovery and Reinvestment Act expenditures that exceed Federal Funds - American Recovery and Reinvestment Act appropriations.

SB0002: Item 76The Legislature intends that the Department of Workforce Services prepare proposed performance measures for all new state funding or TANF federal funds for building blocks and give this information to the Office of the Legislative Fiscal Analyst by June 30, 2015. At a minimum the proposed measures should include those presented to the Subcommittee during the requests for funding. If the same measures are not included, a detailed explanation as to why should be included. The Department of Workforce Services shall provide its first report on its performance measures to the Office of the Legislative Fiscal Analyst by October 31, 2015. The Office of the Legislative Fiscal Analyst shall give this information to the legislative staff of the Health and Human Services Interim Committee.

SB0002: Item 76The Legislature intends the Departments of Workforce Services, Health, Human Services, and the Utah State Office of Rehabilitation provide a report regarding each agency's highest cost individuals and possible efficiencies through coordination, early intervention, and prevention. The Legislature further intends these agencies provide a report to the Office of the Legislative Fiscal Analyst by September 1, 2015. The report shall include the following regarding high cost individuals: 1) a summary, by program, of individuals receiving services in excess of $100,000 total fund annually in any given agency, what percentage of total costs is spent on these individuals, and what the agency is doing to manage these costs in an efficient manner, 2) an assessment of these high cost individuals receiving services from multiple agencies, 3) a description of agency coordination regarding high cost individuals accompanied by a list of areas where agencies specifically coordinate on these high cost individuals, 4) recommendations regarding how best to serve these high cost individuals in least restrictive settings where appropriate and consistent with choice, and 5) recommendation on how agency efforts might better be coordinated across programs.

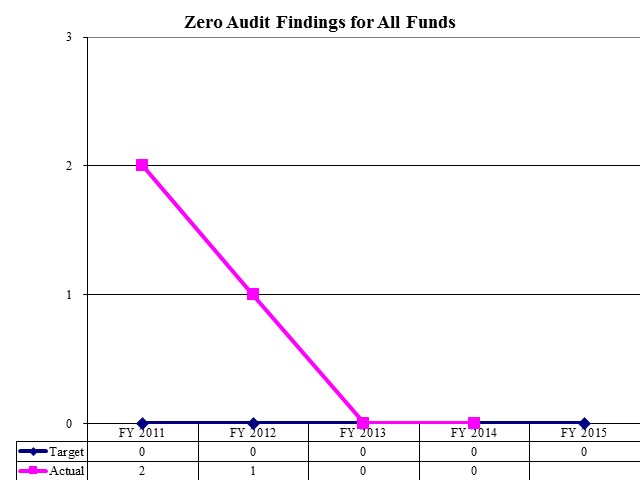

SB0007S01: Item 7The Legislature intends that the Department of Workforce Services report on the following performance measures for the Administration line item: provide accurate and timely department-wide fiscal administration. Goal: manage, account and reconcile all funds within state finance close out time lines and with zero audit findings by January 1, 2016 to the Social Services Appropriations Subcommittee.

SB0007S01: Item 19The Legislature intends that the Department of Workforce Services report on the following performance measures for the Administration line item: provide accurate and timely department-wide fiscal administration. Goal: manage, account and reconcile all funds within state finance close out time lines and with zero audit findings by January 1, 2016 to the Social Services Appropriations Subcommittee.