Temporary Assistance for Needy Families (TANF) is a yearly federal grant that provides multiple services to unemployed and underemployed families with dependent children. The federal grant must be spent within the four TANF purposes: 1) assisting needy families so that children can be cared for in their own homes, 2) reducing the dependency of needy parents by promoting job preparation, work and marriage, 3) preventing out-of-wedlock pregnancies, and 4) encouraging the formation and maintenance of two-parent families. Authority is derived from the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) Public Law 104-193 and 45 CFR 260 et al.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $55,030,000 from all sources for Temporary Assistance to Needy Families. This is an 11.5 percent reduction from Fiscal Year 2015 revised estimated amounts from all sources. The total includes $11,250,000 from the General/Education Funds, a change of 0 percent from revised Fiscal Year 2015 estimates.

In addition to statewide compensation and internal service fund cost increases, the following appropriation adjustments were made during the 2015 General Session:

During the 2014 General Session of the Legislature, the Department of Workforce Services (DWS) indicated to the Social Services Appropriations Subcommittee that it had $107 million in excess TANF spending authority. In response, the Legislature authorized $17.3 million in additional uses for TANF funding and directed DWS, through intent language, to: 1) Insure that the funding for these programs is dependent upon the availability of and qualification for TANF federal funds; 2) Prepare proposed performance measures for all TANF federal fund increases and give this information to the Office of the Legislative Fiscal Analyst (LFA) by June 30, 2014; 3) Make efforts to use TANF funding to increase services to families in need statewide; and 4) Pursue TANF funding for items identified by the Legislature as possible candidates for meeting TANF purposes;

States can use TANF funds on benefits, services, or activities that achieve the 4 TANF goals. DWS determines the eligibility of programs for TANF funding. The $107 million in excess TANF authority is due to the cumulative effect of the TANF block grant funds received from the federal government being more than DWS used in some years. The Legislature will need to determine how much of the excess TANF funding it wishes to appropriate and for what purposes.

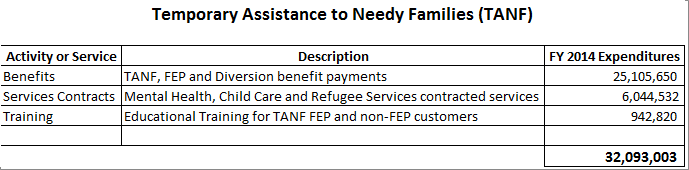

For the most recent completed fiscal year, the following information represents the purposes for which the money was used:

Temporary Assistance for Needy Families Report September 2014

Update on the use of the Temporary Assistance to Needy Families funds

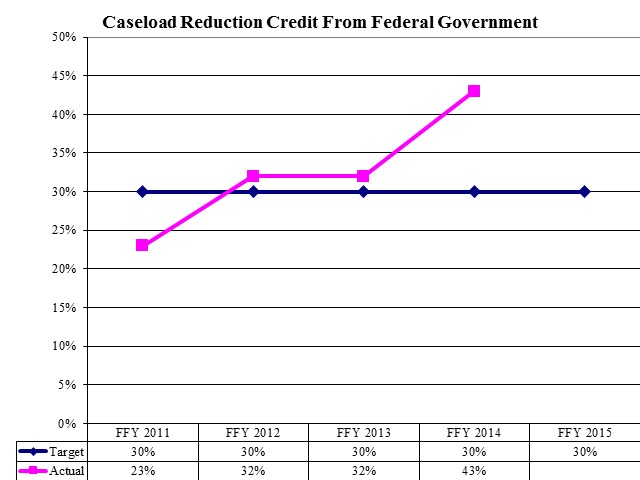

Caseload Reduction Credit

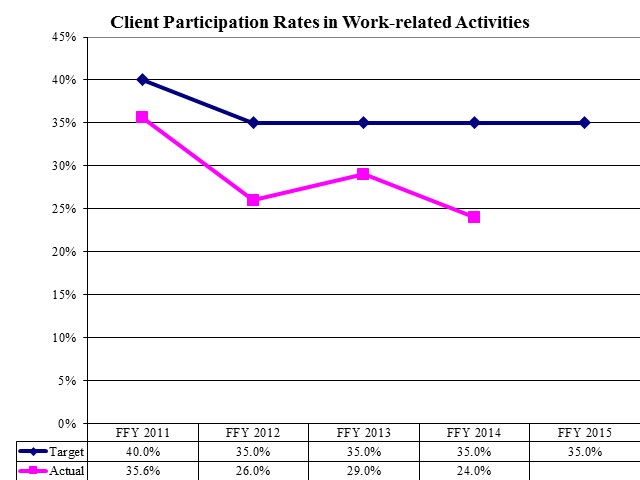

Participation Rates

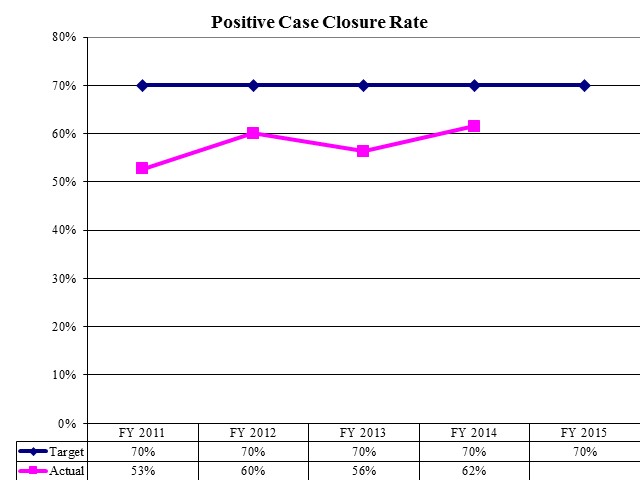

Positive Case Closure Rate

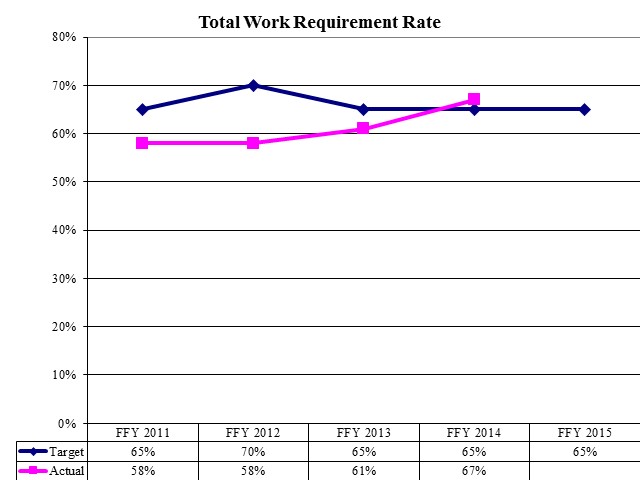

Total Work Requirement Rate

TANF provides cash assistance (using the Family Employment Program or FEP). The Family Employment Program offers financial assistance and help finding employment for low-income parents who are supporting children living in the same household.

Eligibility and Requirements: Assistance is available for the following people, based on income and assets:

- single parents with children under age 18 living with them;

- pregnant women in their third trimester;

- two-parent families with children under age 18 living with them; and

- children being cared for by relatives who are not the parents (under certain circumstances).

Every participating parent works with an employment counselor to write an employment plan with activities that will assist the parent in reaching the goal of supporting the family without assistance. A parent must perform the activities in the employment plan for 30 hours per week (or 20 hours per week if the parent has a child under age 6).

Amounts and Restrictions: Monthly cash assistance is based on household size. For example:

- $399 for a household of two;

- pregnant women in their third trimester;

- $498 for a household of three; and

- $583 for a household of four.

The maximum lifetime duration of the benefit is 36 months.

Scope and Cost of Program: For FY 2013, 25,004 individuals and 10,168 households were assisted by FEP. FEP benefits are funded by federal TANF grants.

Other related TANF funded services that are not considered cash assistance include: TANF - Non FEP training assistance for eligible parents to assist in tuition help for training in occupations in demand; after school programs for children designed to enhance learning and stability in school; and various contracted services that support the economic service areas (local offices) to enhance services in local areas to support work and wage progression for both FEP families and other low-income families needing employment assistance. In general, in order to receive services, a recipient must: 1) be a citizen or eligible alien such as a refugees, 2) live in Utah, 3) have dependent children or be a dependent child, and 4) meet low income criteria.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.